Blog

22/06/2023

Are financial advisers competitive?

8 minute read

New regulations have always driven change throughout the financial advisory industry. But are financial advisers currently equipped for today’s market challenges?

Changing regulations deliver better customer outcomes

The FCA has passed new guidelines for consumer protection: the ‘Consumer Duty’ comes into effect from 31 July 2023. The regulation directs firms to communicate with consumers so that they understand products and services that meet their needs and offer fair value, and get the support they need.

Now that the regulation has passed, firms are gearing up to comply — so far, with varying levels of success.

In October 2022, the FCA reviewed the progress of larger firms on the implementation and governance plans of Consumer Duty. Overall, the FCA found that whilst some firms had made good progress, many were not ready: they had no clear plans, and were unsure of how to implement the Consumer Duty rules.

Shifting trends shake the financial advisory world

Firms must get compliance right to be competitive. We are in the midst of a generational shift in wealth, towards millennial clients. Baby Boomers, with an estimated 30–40 trillion USD in assets globally, are expected to profoundly impact the financial advice industry. Research estimates that between 2007 and 2061, nearly US$58 trillion worth of wealth will be handed over to millennial heirs, whose expectations of financial advisers are completely different from those of their predecessors. Historically, wealth changing hands has led to a change in financial advisers in 90% of the cases. With this massive shift in wealth, the chances are high that financial advisers will be changed as well.

Most future customers are digital natives and expect the same from their financial advisers, along with new and innovative ways to engage and interact with their finances.

According to AKG and Fluido research, phone and email remain the primary channels of communication currently used by advisers. This, along with manual processes and high levels of re-keying, results in inefficiency, poor experience, and higher costs leading to many clients being priced out of advice.

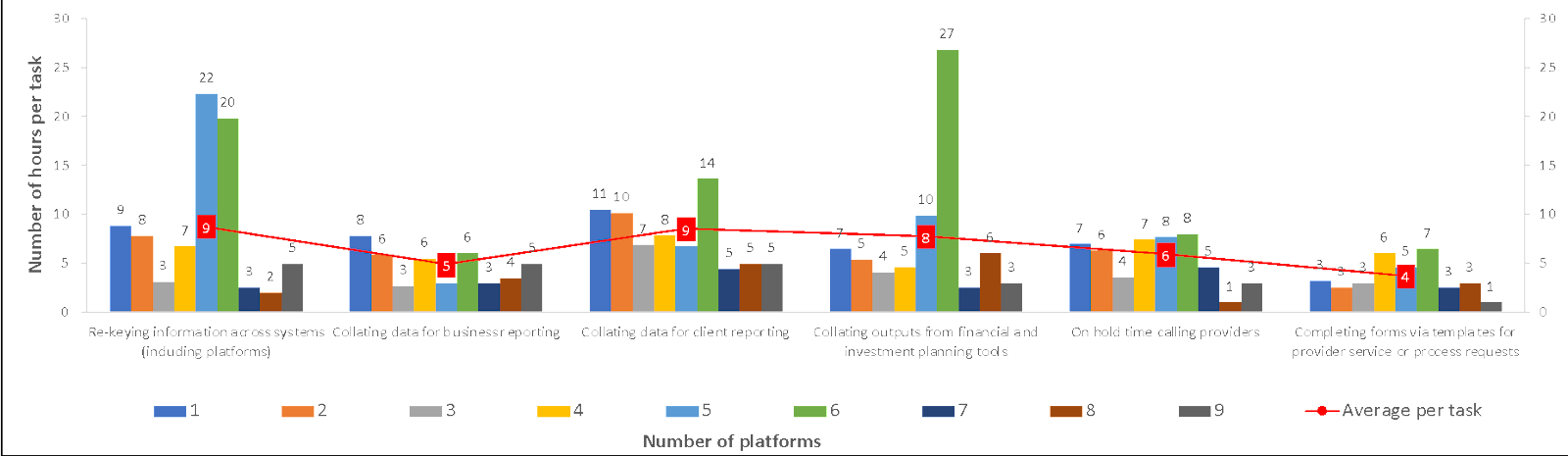

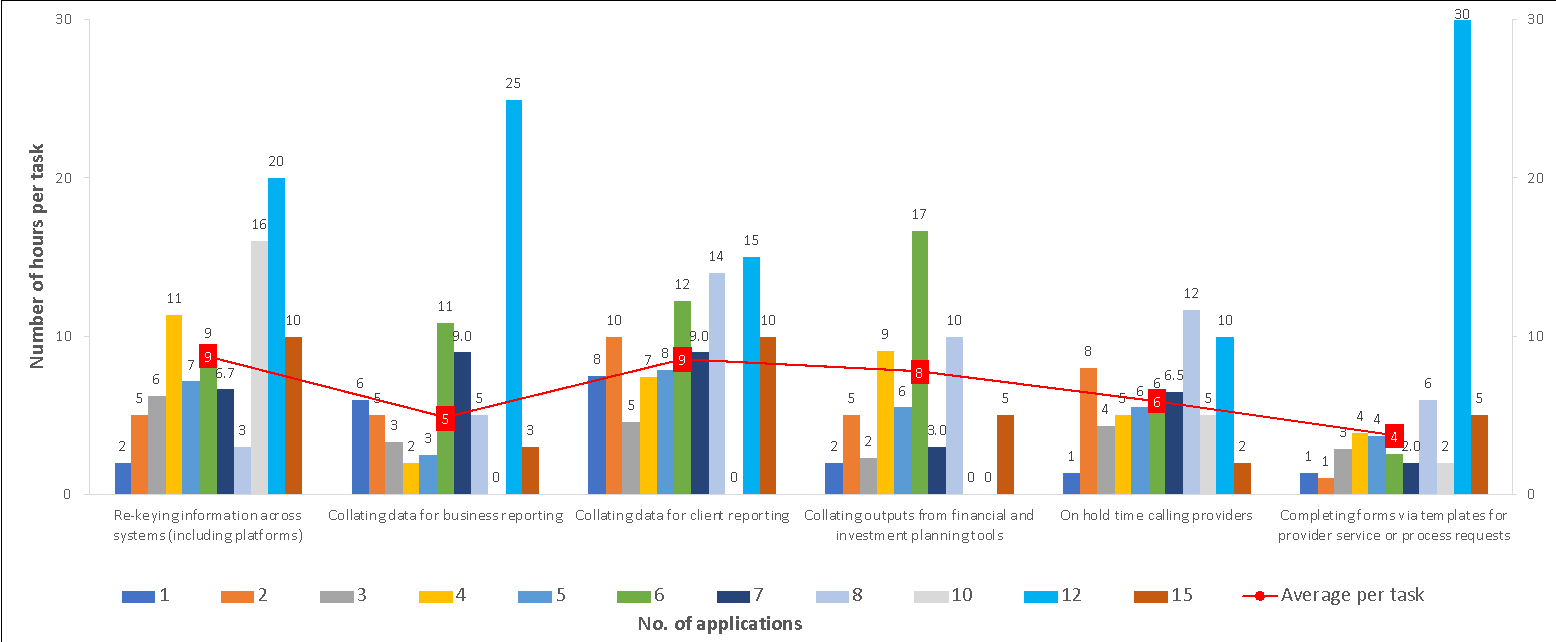

Another survey conducted by Fluido found that 89% of firms use more than 1 platform, while over 50% use 2–3 platforms. The survey also found that over 60% of firms use more than 2 applications, and 50% use 3–6 applications. The number of platforms and applications in use directly affects a firm’s efficiency and speed at performing tasks. Fluido’s survey found that firms using 5–6 platforms (17% of those surveyed) spent the most time per task.

Firms with 12 applications also spent more time on tasks than those firms with fewer applications. A majority of firms have not integrated their applications, which further increases the time per task.

Technology can help

Financial advisory firms with a digital edge and investments in technology will grab a major portion of the transitioning wealth over the next few years. This has the potential to change investor expectations and transform the industry as firms adapt.

Robo-advisory services are also evolving as a key distribution channel with their ability to provide automated advice and wealth planning services 24/7. Independent robo-advisers are direct-to-customer, and many industry players are implementing in-house robo-advisory services by collaborating with fintech startups. Assets managed by robo-advisers are projected to increase from $0.3 trillion to $16 trillion between 2016 and 2025. Financial advisers are expected to embrace the disintermediation of the distribution value chain due to regulatory pressure, advancements in digital technology, and the benefits of reaching customers directly. The time and cost to list and distribute new products will diminish. This makes it possible to attract new segments of retail investors and millennials, and enable new revenue streams.

Analytics is an obvious choice, given the volume of customer data that financial advisers possess. Data can help firms grow their business, predict client behaviour, and change investment goals through targeted client acquisition, better decision-making, and investment management — and can also deliver hyper-personalised products and services across multiple channels. Yet, the technology is not limited to creating better offerings. These advances can also drive significant efficiency in back-end operations.

As an industry, financial advisers were slow on cloud adoption. COVID-19 accelerated that cloud journey and transformed how the technology is used to leverage cost, improve agility, gain real-time insights, accelerate product innovation, and hyper-personalise products and services. Financial advisers are modernising their legacy infrastructure and working towards implementing poly-cloud strategies to support resilience and improve security. By operating towards a poly-cloud strategy, asset managers can benefit from being cloud-agnostic, to enable portability. This further allows firms to automate traditional processes, benefit from open banking, and enhance fraud prevention.

Improve financial advisory efficiency with an all-inclusive platform

Financial advisers need a regulatory-compliant solution that is provider-agnostic and federated to handle multiple platforms. Such a platform must be architected to be data-led and API-integrated, ensuring real-time customer data-led insights and uncomplicated reporting.

For now, assisting firms with a plan to be ready for Consumer Duty is difficult. But the least that adviser firms need is a platform that complies with Consumer Duty rules with an audit trail, as the FCA has been focused on firms demonstrating fair value and outcomes. The financial watchdog is also keen for adviser firms to drive customer insights through data and easy-to-understand presentable dashboards. These capabilities can ensure that adviser firms are equipped to be agile for instant and real-time responses.

All sizes of financial advisory firms struggle with numerous platforms and providers. Integrating disparate technologies, data and processes through process consolidation via the flexible and connected client record can ease their efforts and save time. An API-led integration layer or an integration hub architecture can help firms obtain a 360° customer and business view with a single dashboard of client and connected relationships. This reduces the re-keying of data and enhances user and client experience.

Financial advisers strive to deliver better outcomes for their customers but are often caught in a web of inefficient technology that slows down how they deliver advice. A platform that acts as a one-stop shop can improve their efficiency whilst providing them with an enhanced experience and modern interface. This, in turn, creates sticky customers that transcend generations and opens opportunities to create new service offerings and be future-ready.

This blog post was created in partnership with Infosys Knowledge Institute.

Sharan Bathija

Senior Consultant — Financial Services

Infosys Knowledge Institute

Duncan Muir

Industry Lead (Financial Services)

Fluido

Read next

11/07/2023